4. DLT system trust

The overall trust of a DLT system consists primarily of the five components listed below:

- Transparency of the technology

- Security & stability of the technology

- Decentralisation of operators

- Liability of operators

- Privacy of users

In the previous section What about blockchain, cryptography, decentralisation…? we did not address the security and stability of the technology, as we can assume that the IT systems of legacy financial institutions are equally secure and stable from a technological point of view. Thus, this isn’t an advantage of DLT systems over the legacy financial institutions. However, this does not diminish the importance of this element in the overall trust in DLT systems.

To make it as simple as possible for users to hold trust in a money system, all five of these components are equally (or similarly) vital. It is inadequate to be strong in only four areas, because as soon as one area is neglected, trust in the system as a whole decreases proportionally.

Therefore, if any of the following conditions are met, the system’s overall credibility declines considerably:

- Source code that is not open; no well-defined and publicly visible rules; or inability to verify compliance with said rules;

- utilisation of unstable technology or frequent system outages;

- a person or small group can exert substantial influence over the system’s operation, rules, or development;

- the operators of the system need not fear any consequences in the event of fraudulent activity; or

- all transaction details (who acquired what, when, and where), as well as the identities of those conducting the transactions, are publicly accessible.

Therefore, a system with no transparency, an insecure or unstable technology, very little or no decentralisation, nothing to lose for its operators in the event of fraudulent behaviour, and no privacy for its users has the lowest level of trust and is therefore the most dangerous system for its users.

Compared to this, a system with complete transparency, a very safe and stable technology, high degree of decentralisation, high liability of its operators (bad actors have a lot to lose), and high user privacy protection enjoys the highest level of trust and is thus the safest system for people.

Despite the difficulty (or perhaps impossibility) of quantifying trust in a DLT system, let’s attempt it. A simplified yet descriptive method for determining the overall trustworthiness of a DLT system could be to:

- Evaluate and rank each trust area (this is partially subjective)

- Determine the respective trust factor between 0 and 1 for each area

- Multiply all of these trust factors

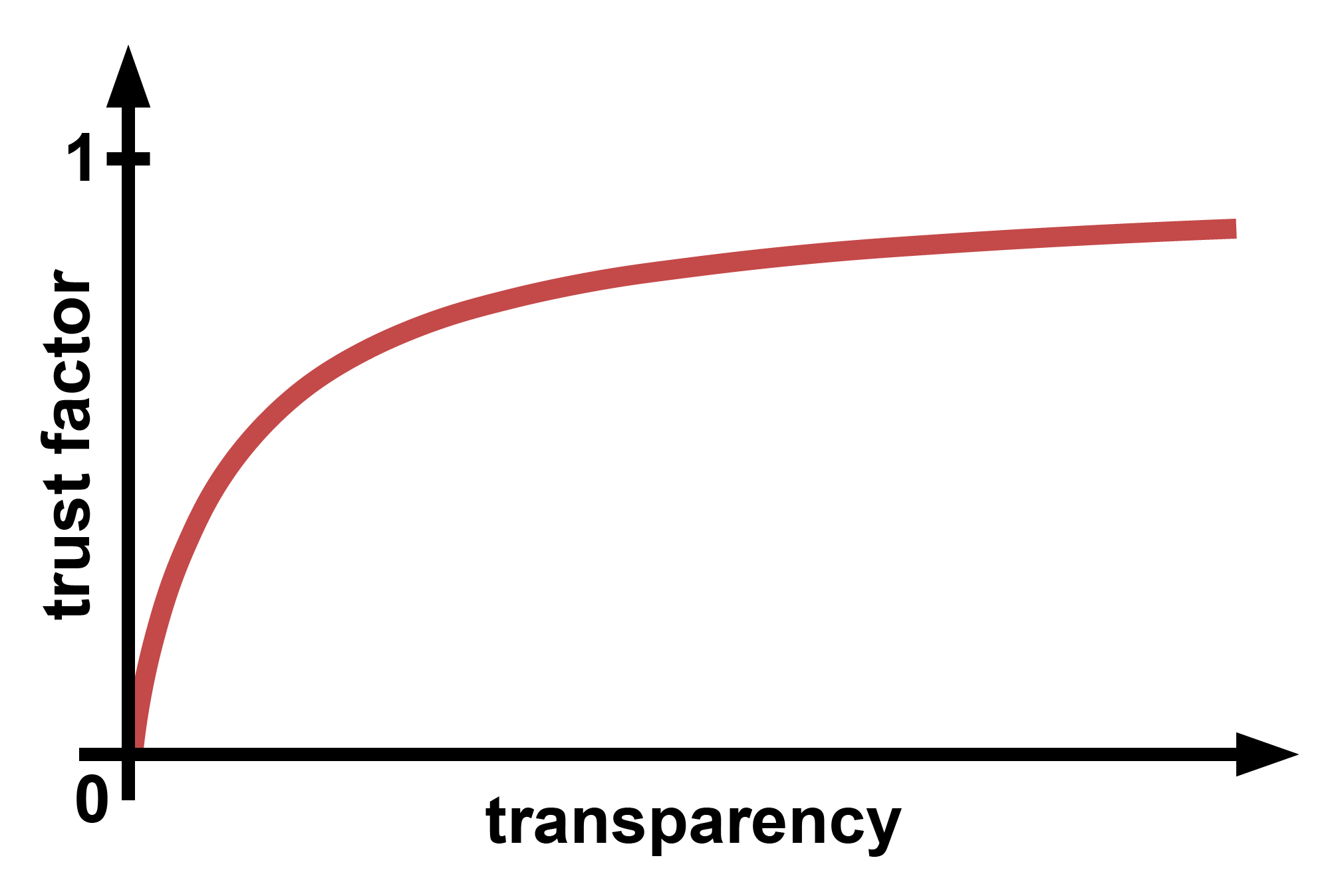

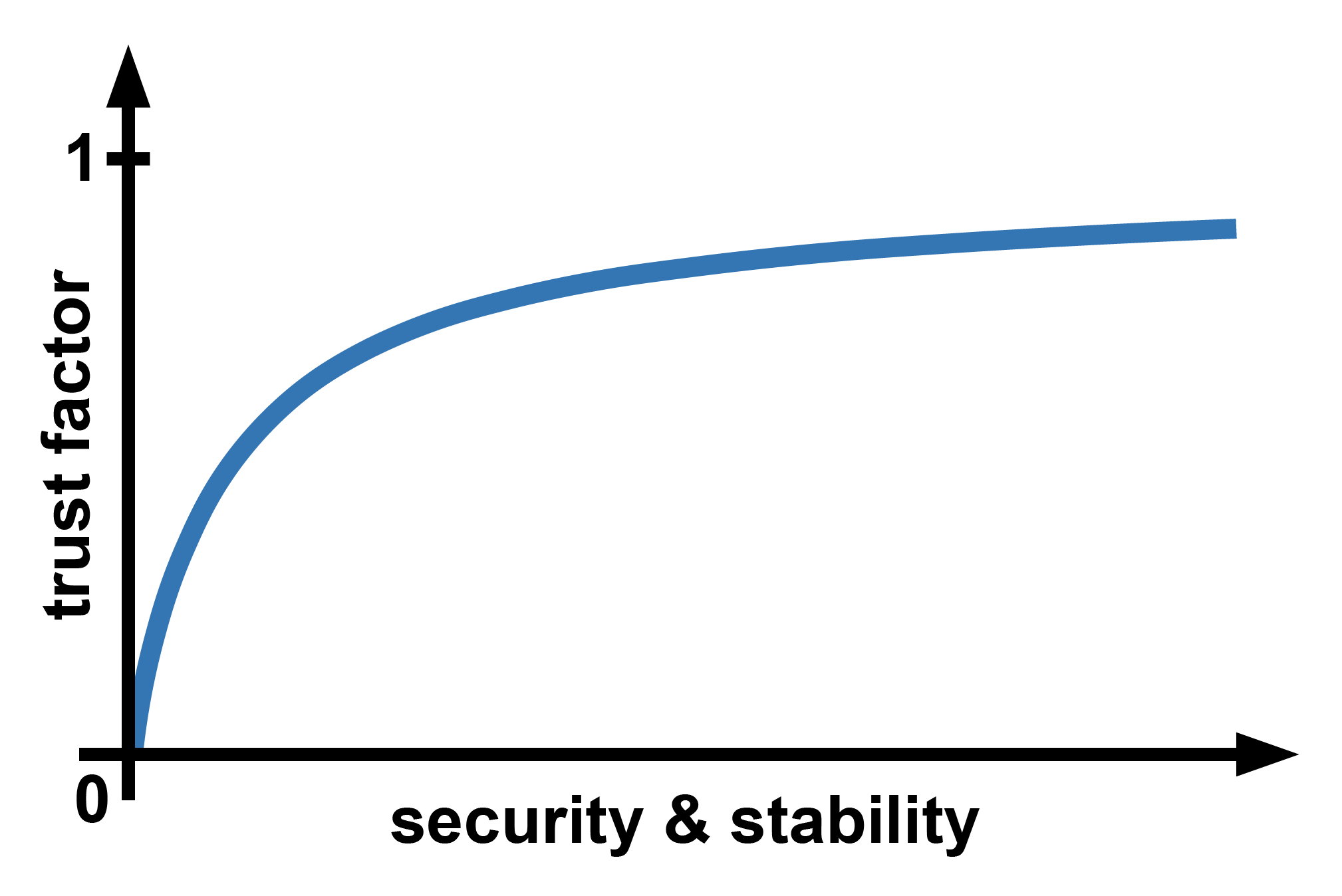

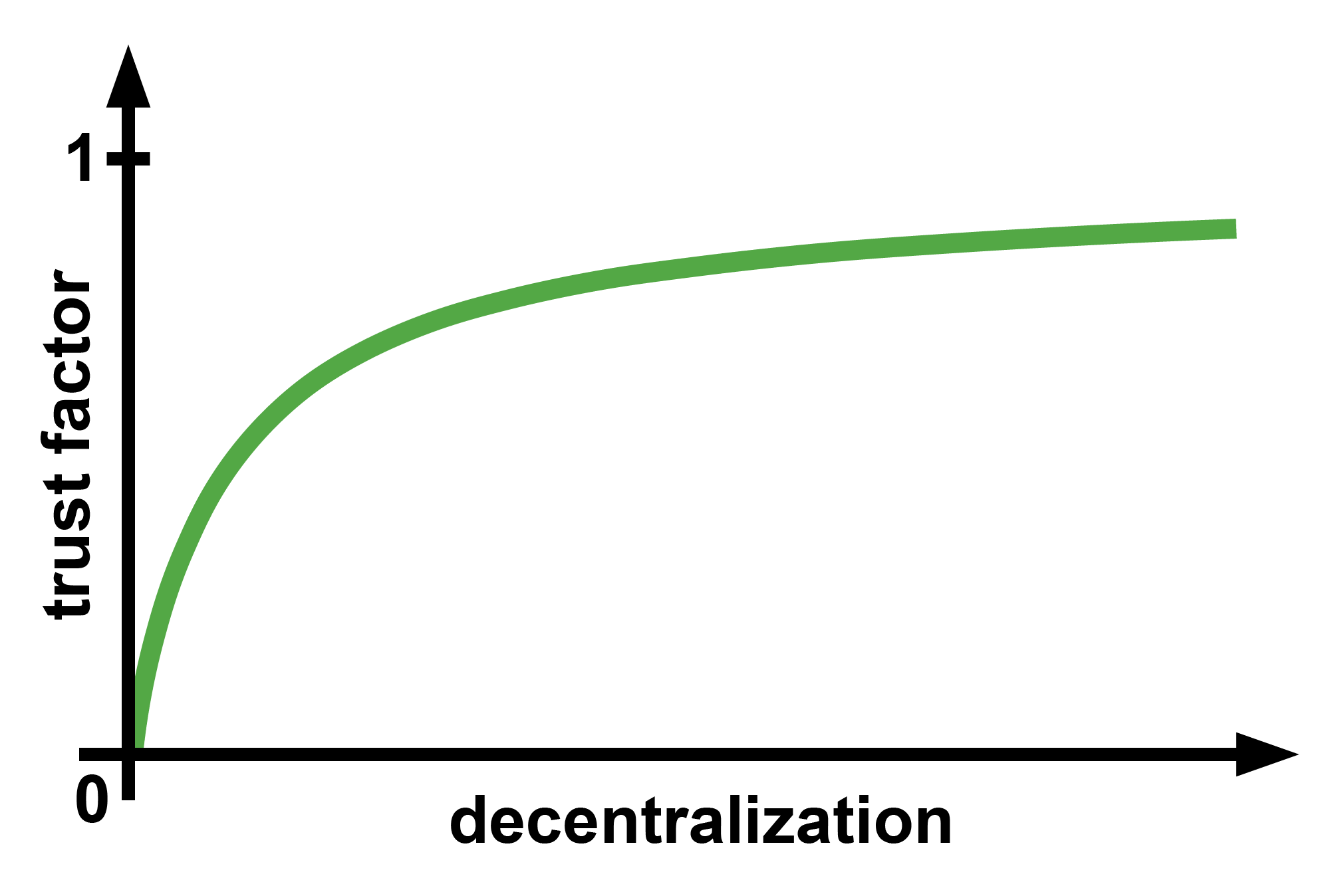

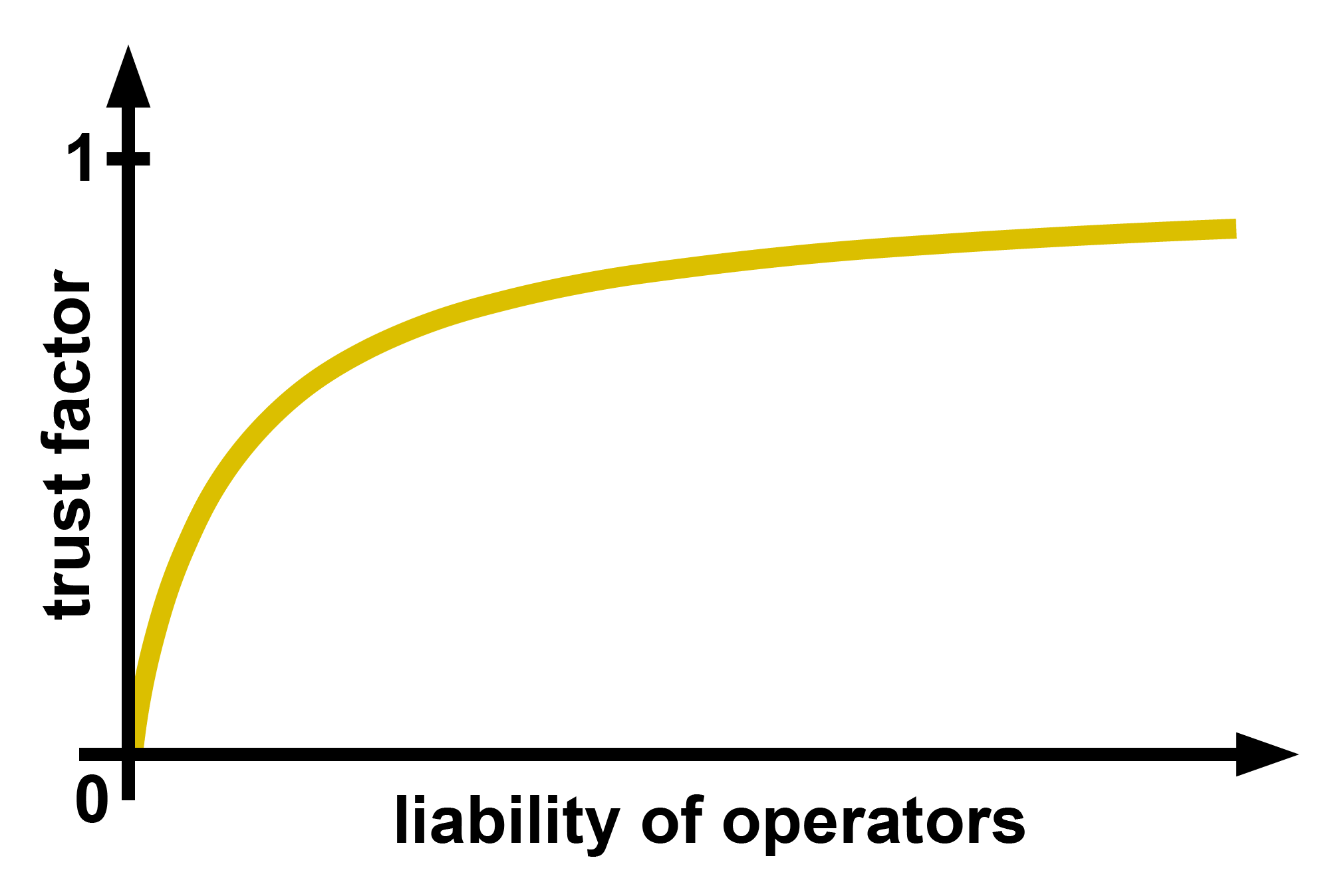

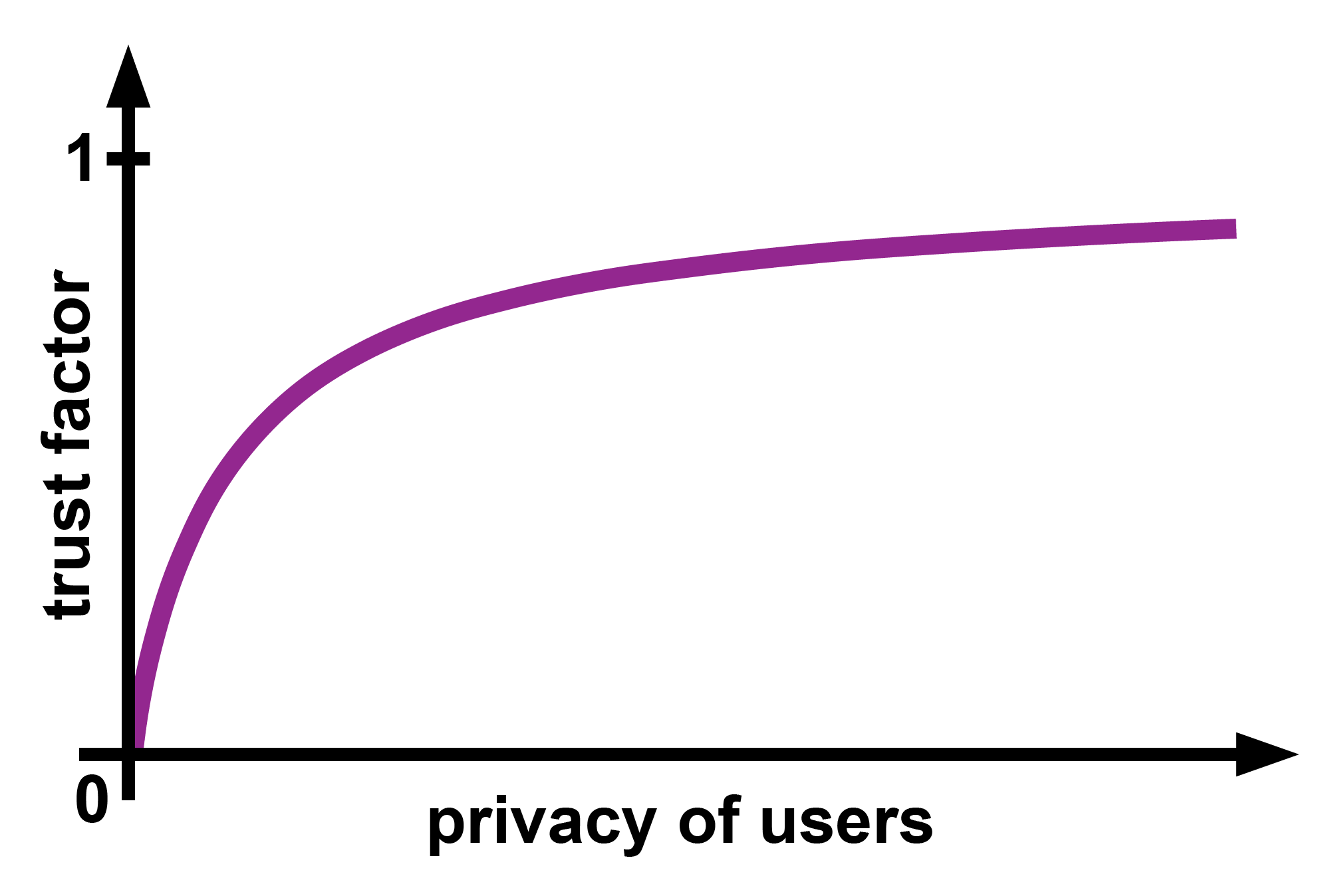

On the X-axis of the subsequent graphs, a value can be assigned based on the degree of transparency, security & stability, decentralisation, operator liability, and user privacy. The Y-axis can then be used to determine the trust factor of the trust area based on the X-axis’ value.

These five trust factors must be multiplied together to determine the DLT system’s overall trust. Thus, the formula could appear as follows:

Consequently, even if only one of the trust factors were to be zero, the system’s overall trustworthiness would also be zero percent.

Now that we have clarified some preconceptions about trust, let’s get back to the underlying cause of the problem relating to our current monetary system.