Part 1: The Problem

Please read this first!

If you want to read this article in one go, rather than section by section, you can find the blog version here.

If you want a better grasp of how our current monetary system works, or if you want to learn more about Bitcoin and blockchain, please refer to the Resources section at the end of this article for a plethora of reputable information.

If you wish to check the (almost 800) sources we have linked to in this article, we strongly suggest you read this article on a desktop computer using a Chromium-based browser (such as Chrome, Edge, Opera, etc.) as we have made extensive use of Chromium’s link to quotes & text feature. By the way: Blue links are links that have not yet been visited. They turn purple when the page behind them is visited.

We do not know if Satoshi is a man, a woman or a group of people. But since Satoshi is a male name and for the sake of readability, we will refer to him as a male person.

The research of this article took about a year and we are aware that it is impossible for anybody to become an expert in multiple complex subjects within this short amount of time. Therefore please bear with us if you spot a mistake or other inconsistencies in the article, and let us know in the comments below so we can correct, improve or clarify them.

Satoshi Nakamoto is a genius.

Although he was not the first to attempt to create a decentralised digital money system, his conception was the first that achieved the breakthrough. In addition to its first-mover advantage, Bitcoin’s overwhelming success and ongoing financial supremacy over competing cryptocurrencies (also known as altcoins) can be attributed to this technology’s incredibly sophisticated and well-designed architecture.

Not only did Satoshi address a multitude of technological obstacles (including the problem of double-spending). But more importantly, he endeavoured to address one of the most pressing problems confronting the world today: the escalating instabilities associated with our current fiat-based financial system. This was undeniably the primary reason behind his creation of Bitcoin.

But does Bitcoin offer the ultimate solution?

To determine this, we must first have a deeper comprehension of the underlying causes of the problem Satoshi wanted to solve. Examining Satoshi’s initial public announcement of Bitcoin, the basis of the problem as he perceived it is readily apparent.

You are encouraged to read the entire announcement, but for the sake of brevity, we will just discuss the areas that are pertinent to our discussion.

Let’s begin by analysing his second paragraph:

The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts. Their massive overhead costs make micropayments impossible.

The issue that Satoshi clearly wants to call our attention to is demonstrated by his repeated use of one word: Trust.

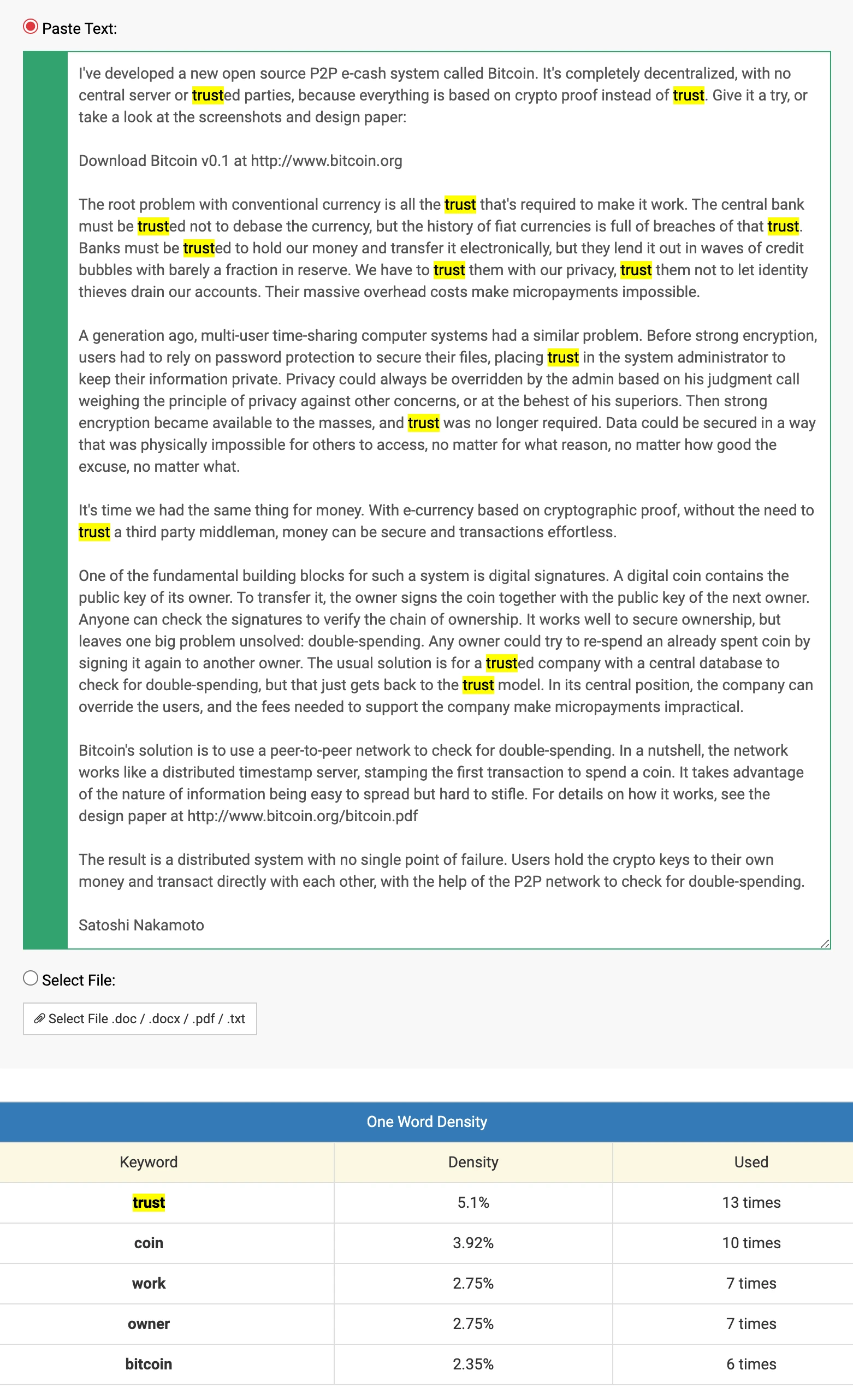

The above paragraph contains six occurrences of the word ‘trust’. And if we analyse his full announcement, we find that the word trust appears a total of 13 times, making it the most commonly referenced keyword in the whole text.

It seems quite evident at this point that there is one thing that fundamentally concerned Satoshi with regard to fiat currencies as well as our current financial system and institutions: Trust.