Causes of the breaches of trust

Most would likely agree that we live in the most prosperous time in human history today. Poverty, sicknesses, and ignorance are receding throughout the world, due in largely to advances in economic freedom. However, we view the growing concentration of power in the financial sector as one of the greatest obstacles in preventing us from achieving our objective of expanding freedom, prosperity, justice, and peace for all human beings.

A lot of people have already noticed that there is something wrong with our incumbent monetary system, but they can’t quite put their finger on it. They just notice that the ever-growing mountain of debt can never be paid back, that there is a lack of money everywhere, that the social issues in our society are increasing, and that the inequality in this world seems to be getting worse and worse. Even without knowing the exact causes, it is clear to many that these issues must somehow be linked to our monetary system, which has led to the aforementioned widespread mistrust of financial institutions.

Satoshi’s initial public announcement of Bitcoin touches on this:

The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts.

Within this statement, Satoshi criticises the following three points:

- debasing the currency

- lending [the money] out in waves of credit bubbles with barely a fraction in reserve

- letting identity thieves drain our accounts

In the past three years, the majority of nations have printed more money than ever before (or, to be precise, entered some large numbers into a software system). And the ramifications of these monetary policies on the middle and lower strata of the population are becoming increasingly severe in many countries.

Elon Musk commented on this in April 2022 by stating:As the saying goes, when the government first prints money, everyone feels like a winner, but in the end no one does.

Ross Hendricks also summed it up well in his LinkedIn post There’s nothing more expensive than “free money”.

However, Satoshi’s criticisms merely represent the tip of the iceberg. Every year, new banking scandals are uncovered, and the number of individuals suffering (whether aware of the cause or not) from the current fiat monetary systems continues to rise. This heavily counteracts the development of economic freedom (which is the main driver of prosperity).

We are not talking about small local community banks, credit unions, etc. but rather big and powerful financial institutions such as:

The longer you study centrally controlled fiat currencies, the more you realise their unfathomable dark side.

Here are just a few of the repercussions of our current monetary system:

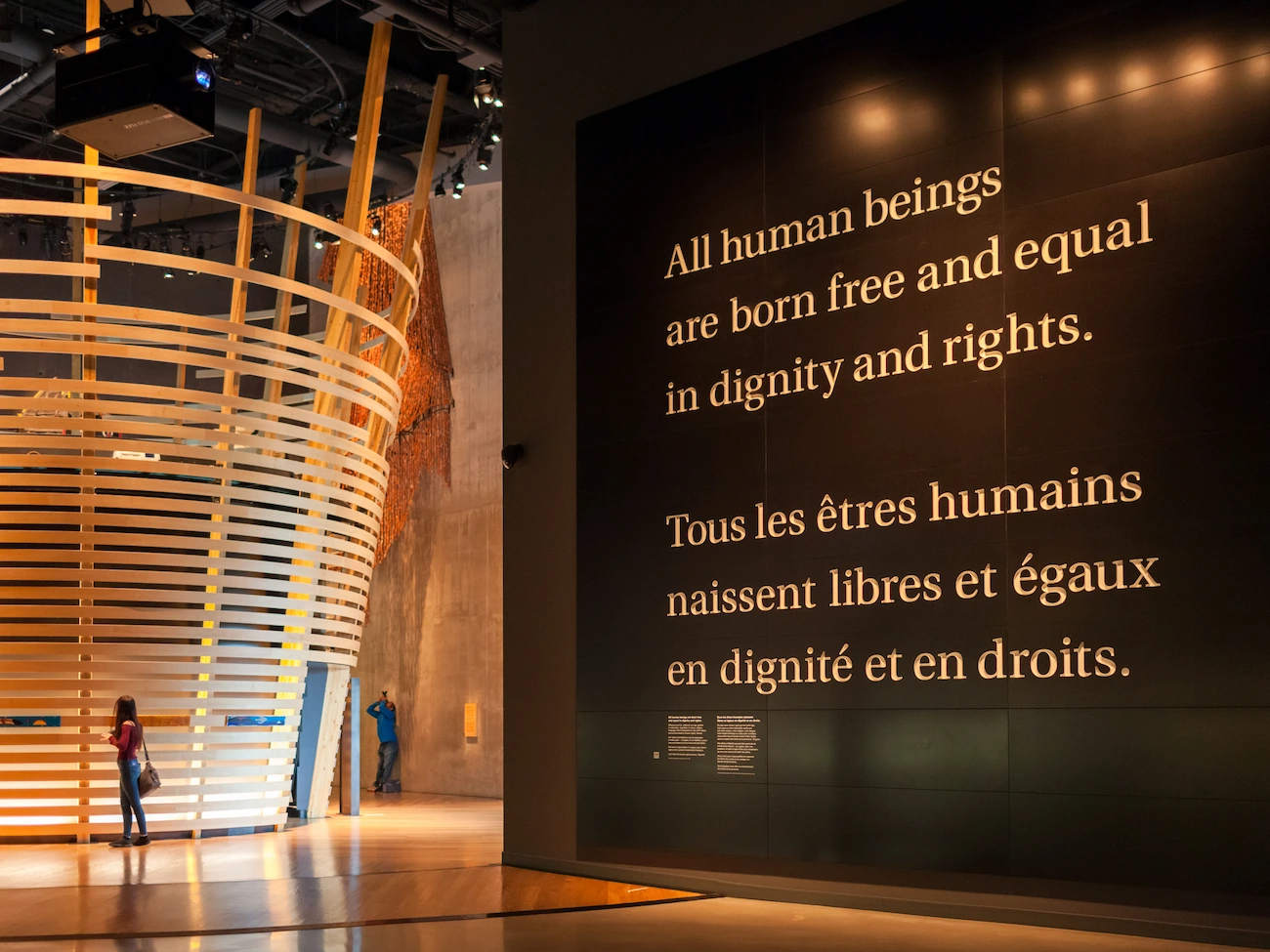

- Human rights violations

- Property

- Expansion of the money supply causes inflation which is a secret theft of time and money

- Printing money is a wealth redistribution scheme from the poor to the rich

- Governments can freeze bank accounts if they have economic issues (like in Argentina in 2001)

- All fiat currencies are collapsing

- Central banks are looting their host nations

- Governments destroy the prosperity of their citizens

- Freedom of speech

- Privacy

- Liberty

- Freedom from slavery

- Equality and non-discrimination

- Security and peace

- Rest and leisure

- Freedom of residence

- Property

- Economic exploitation (of developing countries)

- Environmental degradation

- The dirty investments of major banks around the world

- Banks lent $2.6tn linked to ecosystem and wildlife destruction in 2019

- World Bank and IMF actions have immense environmental consequences

- Many banks are well-documented financiers of the climate crisis

- Global banks ‘failing miserably’ on climate crisis by funneling trillions into fossil fuels

Despite these warnings, Woodrow Wilson still signed the 1913 Federal Reserve Act. A few years later he wrote:I believe that banking institutions are more dangerous to our liberties than standing armies.

Josiah Stamp, a director of the Bank of England (the central bank of the United Kingdom), even went so far as to claim:I am a most unhappy man. I have unwittingly ruined my country. A great industrial nation is controlled by its system of credit. Our system of credit is concentrated. The growth of the nation, therefore, and all our activities are in the hands of a few men. We have come to be one of the worst ruled, one of the most completely controlled and dominated Governments in the civilized world no longer a Government by free opinion, no longer a Government by conviction and the vote of the majority, but a Government by the opinion and duress of a small group of dominant men.

Banking was conceived in iniquity and was born in sin. The bankers own the earth. Take it away from them, but leave them the power to create money, and with the flick of the pen they will create enough deposits to buy it back again. However, take away from them the power to create money and all the great fortunes like mine will disappear and they ought to disappear, for this would be a happier and better world to live in. But, if you wish to remain the slaves of bankers and pay the cost of your own slavery, let them continue to create money.

Not to mention CBDCs, which many agree will be a total human rights disaster. They are worse in every aspect of the human rights violations mentioned above than the current financial fiat system. Despite this, many countries already have a first version in operation, or are currently in the process of testing or developing their own CBDC.

Some may wonder how all this can still be happening in the 21st century? Well, since money is power, the centralisation of money is therefore centralisation of power. And as accurately observed by Lord Acton:

Power tends to corrupt, and absolute power corrupts absolutely.

This maxim is always true independent of the century we live in.

As the tendency towards centralisation continues to grow the serious harmful implications of centralised fiat currencies on the daily lives of a large number of people and our environment will intensify even further.

So, the real problem is that the powerful financial organisations have brazenly abused the trust of the public many, many, many, many, many, many, many, many, many, many, many, many times and have no intention of restoring it. But strictly speaking, it is not the financial institutions themselves (since institutions cannot act on their own accord) but their operators who have abused the public’s trust. Reality has demonstrated that the untouchable operators of these systems tend to act primarily to their own advantage (or that of other influential groups of individuals) and to the detriment of the general public. Unfortunately, this always results in greater poverty for the vast majority of the population and greater wealth for only a few. In other words, it’s an unjust redistribution from the poor to the rich.

This has understandably led to widespread distrust of these financial institutions and the only logical consequence is that the disappointed and frustrated people will seek alternatives.

Regardless of the political spectrum people associate themselves with, the point on which all of them would agree is there should be more prosperity and less poverty in the world. Thus, all people agree on this essential political goal, with only differing opinions on how to get there.

However, increasing centralisation in the financial sector is certainly not getting us any closer to our common goal of less poverty and more prosperity for everybody. As documented throughout this article, many of our socio-political problems stem from our fiat monetary system.

If we want to have a chance of tackling any of the other big social issues we’ve got to figure out the money issue [first].

Ben Dyson

Michael Saylor also gave weight to the fact that the majority of the world’s issues are caused by our fiat monetary system in a recent interview with Lex Fridman:

I believe that Bitcoin is a massive breakthrough for the human race that will cure half the problems in the world and generate hundreds of trillions of dollars of economic value to the civilization.

German banking and development economist Prof. Richard Werner is even confident that Keynes’s prediction that “we would only have to work 15 hours a week” would have come true if the current centralised monetary system had not led to such an unjust distribution of wealth.

But, if we know that the malfeasance, failures, and even crimes of powerful financial institutions result in less prosperity and increased poverty overall, shouldn’t we all do everything in our ability to prevent this? Especially since the next financial crisis is already looming.

Everybody, the left and the right, you know, the communists and the fascists, they’re all fighting about wealth. Because everybody is fighting about wealth when you have a downturn.

Ray Dalio

We presume that the majority of individuals would prefer to prevent this, but just don’t know how.