The main driver of scalability

As addressed previously in the list of basic characteristics of a future-proof money system, Bitcoin fulfils all of these characteristics mentioned. And even the first four characteristics of the consensus mechanism (secure, reliable, immutable and fair) can be attributed to Bitcoin.

That said, Bitcoin’s consensus mechanism (Proof of Work) fails when it comes to the following two characteristics:

- scalable, and

- efficient / sustainable.

Furthermore, the listed transaction characteristics, which are dependent on the consensus mechanism, also cannot be achieved using Bitcoin’s Proof of Work.

As a result, it is the consensus mechanism that severely limits Bitcoin’s scalability.

We must determine what the attributes of the consensus mechanism are dependent upon, in order to design a consensus mechanism that combines all of the characteristics required for a future-proof money system.

Previously, we grouped all of the characteristics a future-proof money system needs into three categories:

- The basic characteristics of the money system

- The characteristics of the consensus mechanism

- The characteristics of transactions

However, since the characteristics of transactions depend directly on the consensus mechanism, these two categories can be combined. This leaves us with only two main components that are responsible for all the characteristics of a decentralised money system:

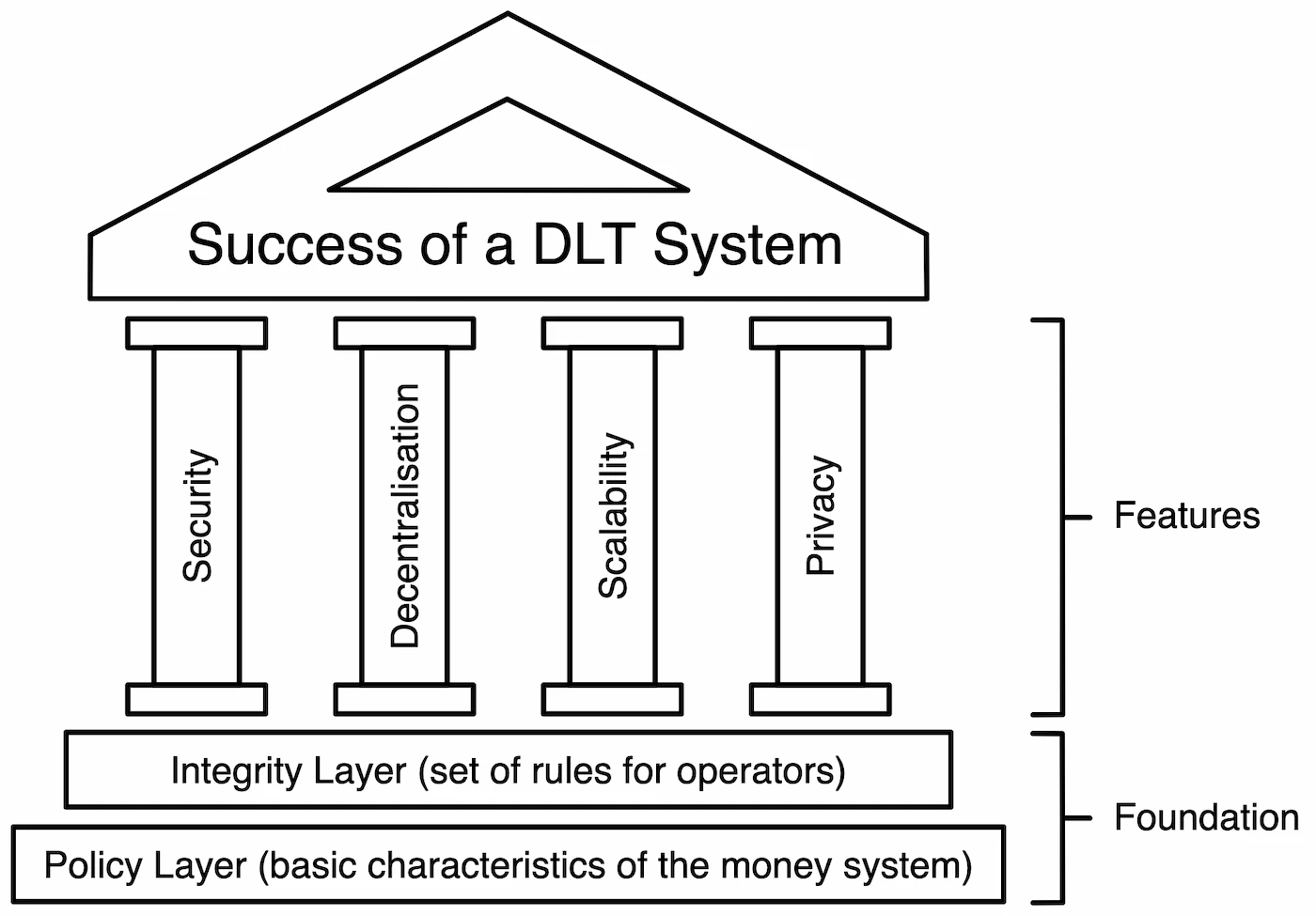

- The basic characteristics of the money system (Policy Layer)

- The characteristics derived from the consensus mechanism (Integrity Layer)

These two fundamental layers, when combined, form the foundation of a decentralised money system, as they are responsible for all of the system’s characteristics. The Policy Layer is made up of the system’s principles, which are defined when it is created. The Integrity Layer, which is built on top of this, is in charge of guaranteeing the integrity of the system at all times (via the rules and consequences for participation in the network’s operation). The characteristics derived from the consensus mechanism are determined by the specific rules and consequences.

Moreover, every DLT system includes a variety of features that heavily influence the system’s success. These features include, for example, security, decentralisation, scalability, privacy, and so on. However, these features cannot simply be present or absent, but each of them has a certain scope in which this feature is made possible. This means that the difference between features and characteristics is that the characteristics describe properties (e.g. a system is decentralised, even if it has only 3 operators) and the features describe the extent to which these properties actually can be achieved (e.g. in the case of decentralisation: one decentralised system might already struggle with as few as 30 operators but another one can easily have tens of thousands of operators).

The degree to which those features can be achieved depends entirely on the system’s foundation. Thus, the overall success of a DLT system depends entirely on its foundation.

Here is an illustration of this concept:

Despite Satoshi’s intention to establish a system that does not require any trust at all, he intuitively selected the basic characteristics of the money system in such a way that they maximise user trust. However, he did not achieve this intuitive stroke of luck in the design of the consensus mechanism.

Satoshi had the right intentions when he created Bitcoin, but when he designed the consensus mechanism, he attempted to eliminate trust from the system without thoroughly investigating the issue of trust.

However, switching from institutional to interpersonal trust brings huge potential for DLT systems. Unfortunately current solutions do not capitalise on this potential. Instead, they strive to minimise or even eliminate trust. This is fundamentally why the perfect, future-proof money system still does not exist to this day.

We are certain that there is a better solution!