The solution to the Blockchain Trilemma

The Blockchain Trilemma has already been briefly mentioned in the Requirements for a future-proof money system.

However, here’s a quick synopsis from Binance:

The popularity of crypto and blockchain is growing exponentially, and so is the number of users and transactions. While it’s easy to see how revolutionary blockchain is, scalability – a system’s capacity to grow while accommodating increasing demand – has always been a challenge. Public blockchain networks that are highly decentralized and secure often struggle to achieve high throughput.

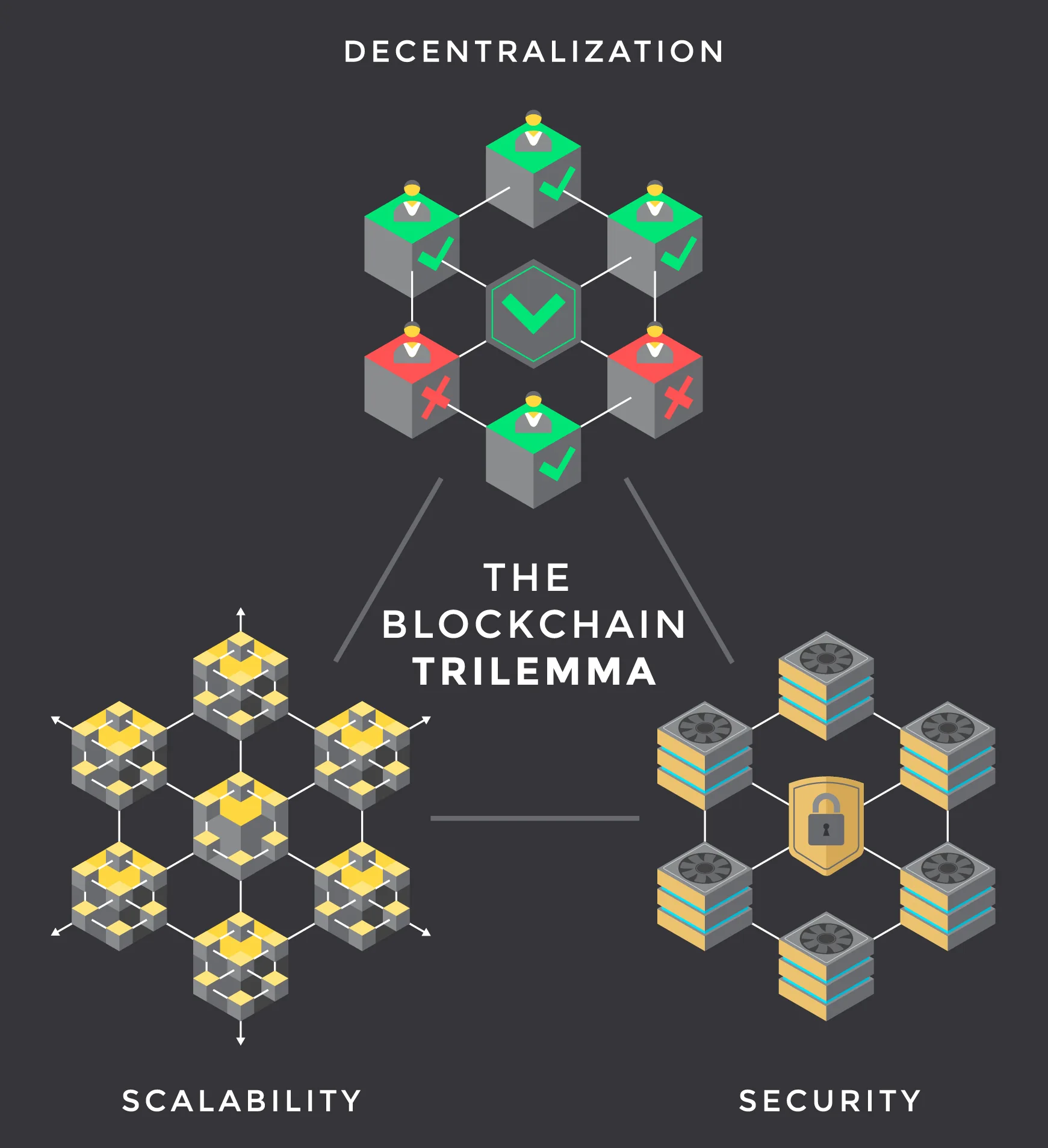

This is often described as the Blockchain Trilemma, which states that it’s virtually impossible for a decentralized system to simultaneously achieve equally high levels of decentralization, security, and scalability. Realistically, blockchain networks can only have two out of three factors.

Swyftx Learn also concludes the following:

There have currently been a number of attempts to solve the blockchain trilemma, but no universal solution has been found yet.

Until now…

Not a single DLT system has been able to solve the Blockchain Trilemma, because they are all either attempting to solve it with layer 2 technology like off-chain, sidechains, payment- and state-channels, ZK-rollups, etc. or have had to compromise on decentralisation and/or security in the pursuit of scalability, which obviously has even less chance of success.

This means that all approaches to solving the Blockchain Trilemma problem only shift around the respective technology on the trilemma chart instead of solving it, which defeats the purpose. No matter whether scalability is attempted on layer 1, layer 2, or even on higher layers, it always causes the system to be less decentralised and/or less secure on the scaling layer and the layers above. However, if global adoption is our objective, then at a certain point the scaling layer will inevitably be the most used layer. Hence, even DLT systems with a highly decentralised and secure base layer have a problem if the most used layer has to compromise on either of these two vital properties.

Furthermore, it is incorrect to compare the scaling of a DLT system via additional layers with the layer model of the internet. The purpose of the layered architecture of these two technologies is fundamentally different and in terms of scalability even opposite. In the layered model of the internet protocol suite (TCP/IP), performance decreases with each additional layer (due to the added overhead). Each layer of the TCP/IP model provides an additional level of abstraction to the underlying hardware in comparison to the “layers” of blockchain systems, which in most cases are completely independent technologies that are merely able to communicate with the systems of the other “layers”.

These circumstances lead to the unfortunate realisation that blockchain technology could never be the optimal solution for a future-proof money system. Such a system requires a scalable DLT solution that does not compromise decentralisation or security on any layer to achieve scalability.

Since blockchains of any kind will always be subject to this trilemma by their very nature, the only way to escape this predicament is not to use a blockchain. At least not as the database of the ledger.

As stupid as it may sound, but that is the only solution to the Blockchain Trilemma.

“How to solve the Blockchain Trilemma?”

“Just don’t use a blockchain.”

The Authors

But what is the alternative?