Why digital money can never be trustless

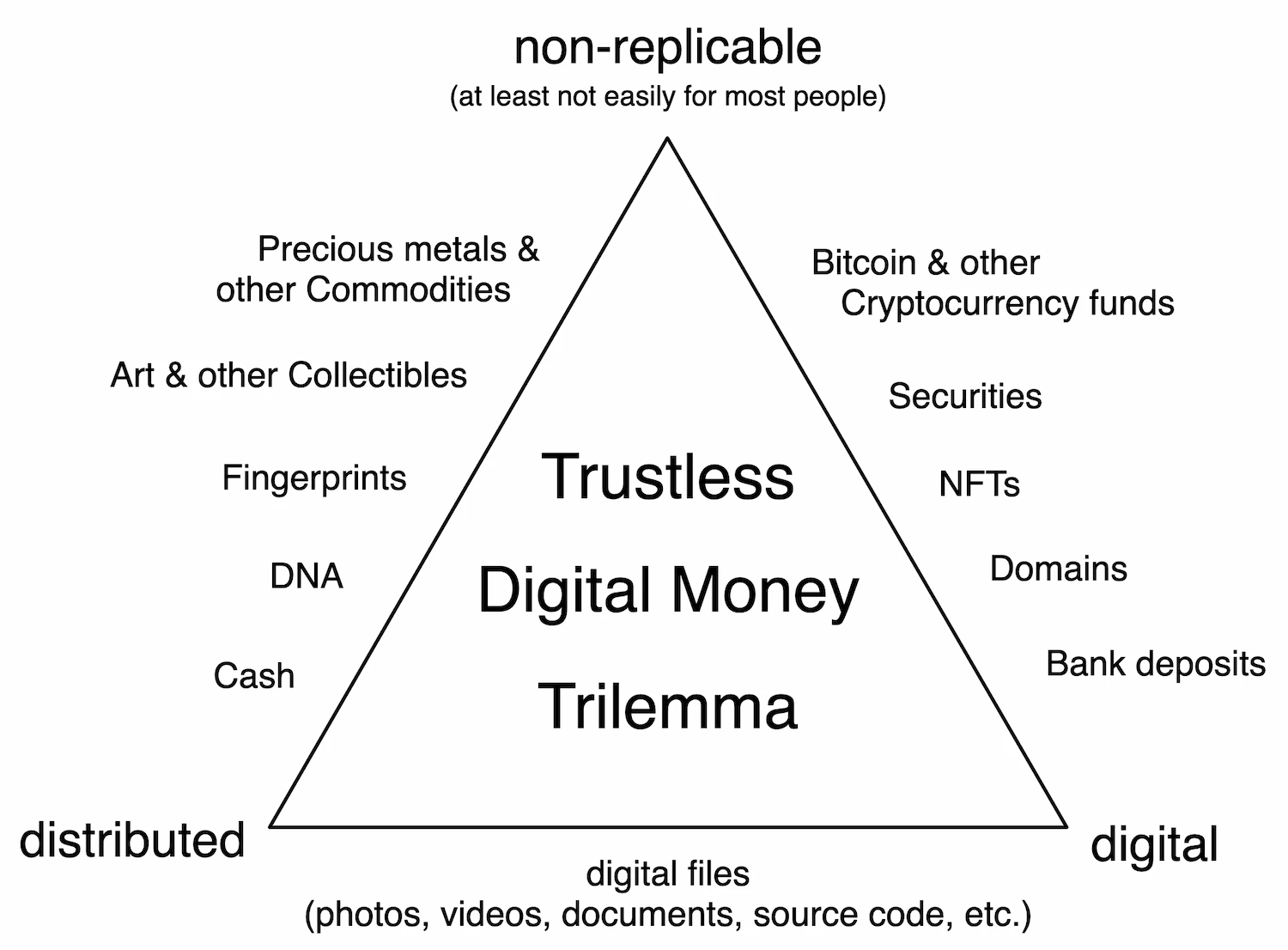

If it is impossible to create a true digital gold equivalent, this presents us with the following challenge, which we call the Trustless Digital Money Trilemma:

Ultimately, this means that if you want to create a trustless digital money (digital money with the same attractive properties as gold, apart from being tangible), you would have to be able to own it without the information about ownership needing to be stored anywhere other than on the respective owner’s device(s) (i.e. without the need for a ledger). In the figure above, however, it is striking that all of the examples listed, which are digital and non-replicable, use some kind of centralised or decentralised ledger to keep records of holdings and transactions (such as a blockchain in the case of Bitcoin).

The reason all digital representations of value must store records somewhere shows us that something of value is only valuable as long as it is not easily replicable. In other words, if you have to choose between ‘non-replicable’ and ‘distributed’ as a property of digital money, the obvious choice would have to be non-replicable since money that can be replicated holds no value. However, this implies that we must abandon the distributed property. And this in turn means that if the holdings and transactions have to be stored and processed by trusted third parties, a digital money system can not be considered trustless.

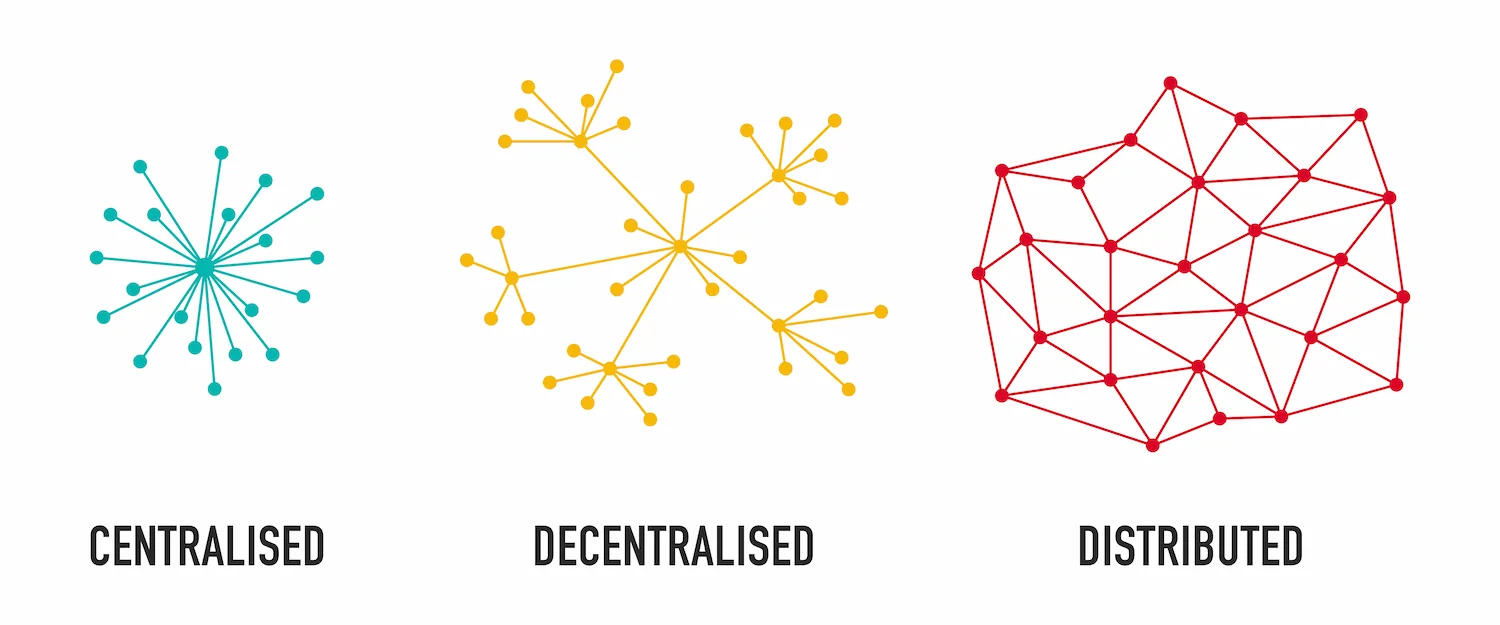

So, if a distributed digital money system is technically impossible, we are only left with decentralised or centralised alternatives. Technically speaking, a centralised system would be much more efficient and easier to implement than a decentralised system; therefore, we should first consider whether a decentralised system is even necessary? Decentralisation would in fact be unnecessary if a single central authority could solve the trust issue.

Unfortunately, there has never been a single authority (person, organisation, government, etc.) in the entire history of humanity that enjoyed the complete trust of all individuals, regardless of how much good they have done in the past or how honourable their intentions may have been. Everybody has critics, including the most widely admired people of the 20th century. Especially bankers, politicians, and government ministers, who wield the most authority over our monetary systems are actually one of the least trusted professions according to a survey conducted by IPSOS in 2019.

Even if there were a single authority that enjoyed the complete trust of all people, there would still be no guarantee that this authority would remain true to its high standards and exemplary conduct, creating a single point of failure. For this reason, a centralised system is unsatisfactory.

To minimise the risk of a breach of trust, the only option left is a decentralised system. Spreading the responsibility for the integrity of a system across many different operators is clearly beneficial to its trustworthiness.

We argued that a digital money system can never be fully distributed (like gold), but rather needs a ledger that is operated by a decentralised network of trusted third parties. Therefore, we believe that the term Distributed Ledger Technology (DLT), which is commonly used to describe blockchain-based solutions and the like, is not entirely accurate. Instead, a better term might be: Decentralised Ledger Technology (which means we can continue to use the abbreviation DLT).

This ultimately means that any digital money system cannot avoid intermediaries who must be responsible for storing the ledger and processing transactions. Nonetheless, we are able to avoid centralisation by involving a large number of intermediaries. By doing so, such a system is neither considered distributed nor centralised, but becomes a decentralised system.